In today’s financial landscape, the demand for credit repair specialists is on the rise. With many individuals seeking to improve their credit scores for better loan terms and financial opportunities, a career in credit repair offers not only job security but also the satisfaction of helping others regain their financial footing. This article will guide you through the essential steps to become a credit repair specialist, covering everything from education and skills to starting your own credit repair business.

Understanding the Role of a Credit Repair Specialist

A credit repair specialist assists clients in improving their credit scores by identifying errors on credit reports, disputing inaccuracies, and providing guidance on responsible credit management. This role requires a blend of financial knowledge, communication skills, and a commitment to ethical practices.

Why Pursue a Career in Credit Repair?

- Growing Demand: As more people become aware of the importance of credit scores, the need for specialists continues to grow.

- Flexibility: Many credit repair specialists work independently, allowing for flexible hours and the ability to work from home.

- Rewarding Work: Helping clients achieve their financial goals can be incredibly fulfilling.

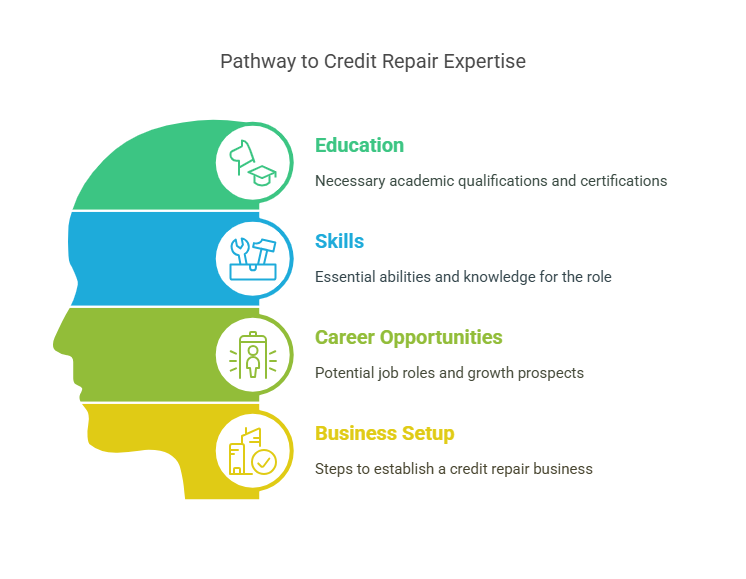

Step-by-Step Process to Become a Credit Repair Specialist

1. Gain Relevant Education

While formal education is not strictly required, having a background in finance, business, or a related field can be beneficial. Consider pursuing:

- Associate or Bachelor’s Degree: A degree in finance, business administration, or accounting can provide a solid foundation.

- Online Courses: Many platforms offer courses specifically focused on credit repair.

2. Develop Essential Skills

To succeed as a credit repair specialist, you should cultivate the following skills:

- Analytical Skills: Ability to analyze credit reports and identify discrepancies.

- Communication Skills: Strong verbal and written communication skills are crucial for explaining complex information to clients.

- Attention to Detail: Precision is key when dealing with financial documents and disputes.

3. Obtain Certifications

Certifications can enhance your credibility and demonstrate your expertise. Consider obtaining:

- Credit Repair Industry Association Certification: This certification is recognized in the industry and can help you stand out.

- Other Relevant Certifications: Look for additional certifications in financial counseling or credit management.

Exploring Credit Repair Classes and Training Programs

Credit Repair Classes

Investing in credit repair classes can provide you with in-depth knowledge and practical skills. Look for:

- Local Community Colleges: Many offer courses in credit repair and financial literacy.

- Online Learning Platforms: Websites like Udemy and Coursera offer specialized courses.

Credit Repair Training Free Resources

If you’re looking to save on costs, there are several free resources available:

- Webinars and Workshops: Many industry associations offer free training sessions.

- YouTube Tutorials: Numerous experts share valuable insights and tips on credit repair.

Starting Your Own Credit Repair Business

Legal Requirements

Before launching your credit repair business, ensure you understand the legal requirements:

- Business License: Check local regulations to determine if you need a business license.

- Compliance with the Credit Repair Organizations Act (CROA): Familiarize yourself with the laws governing credit repair services.

Software Tools

Investing in the right software can streamline your operations. Consider tools for:

- Credit Report Analysis: Software that helps analyze and dispute inaccuracies.

- Client Management: CRM tools to manage client relationships and track progress.

Client Acquisition Strategies

Building a client base is crucial for your success. Here are some effective strategies:

- Networking: Attend industry events and connect with potential clients.

- Online Marketing: Utilize social media and SEO strategies to attract clients.

- Referrals: Encourage satisfied clients to refer others to your services.

The Importance of Industry Certifications

Obtaining certifications from recognized associations, such as the Credit Repair Industry Association, can significantly boost your credibility. These certifications not only validate your expertise but also instill trust in potential clients.

Conclusion: Take Action Today!

Becoming a credit repair specialist can be a rewarding career choice that allows you to make a positive impact on people’s lives. By following the steps outlined in this guide—gaining education, developing skills, obtaining certifications, and starting your own business—you can embark on a fulfilling journey in the credit repair industry.